Lloyd Goldman Refis Montauk Resort After Special Servicing

After weeks of uncertainty, Lloyd Goldman’s BLDG Management finally refinanced Gurney’s Montauk Resort & Seawater Spa.

Smith Hill Capital and Bain Capital provided $235 million to BLDG and partner Metrovest Equities to refinance the East End commercial property, the Commercial Observer reported. A JLL Capital Markets team including Christopher Peck, Kevin Davis and Mark Fisher arranged the loan.

“Gurney’s Montauk is an exceptional and iconic property in a one-of-a-kind location with world-class amenities,” BLDG executive Justin Kleinman said in a statement following the deal.

It’s been a whirlwind stretch for Gurney’s.

BLDG and Metrovest bought Gurney’s in 2014 and pumped $54 million into renovating guest rooms, common areas, amenities and restaurants and building out a $16.4 million spa that pulls from ocean water to fill a full-size swimming pool.

Late last year, it defaulted on a $271 million loan it received in 2021; BLDG attributed it to an administrative hiccup holding up a loan extension. As part of the special servicing, Gurney’s was recently reappraised at $280 million, a 15 percent increase from the $244 million value when a loan was originally made.

In February, the resort reopened following some time offline for renovations. That same month, BLDG scored another year to pay off the debt. The trade-off was a $9.4 million paydown of the loan and a $3.1 million personal guarantee.

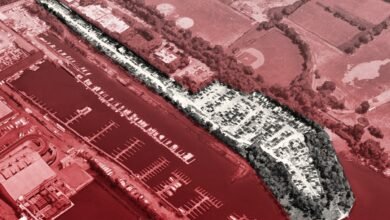

The 158-key hotel in Montauk sits on 20 acres and features a 2,000-foot private beach and 30,000-square-foot spa. The resort has 109 guestrooms, 35 suites, eight beachfront cottages and six residences, as well as five restaurants.

Read more

Lloyd Goldman’s Montauk resort nabs higher valuation after special servicing

Lloyd Goldman coughs up $9M, inks personal guarantee to extend Montauk Resort loan

Ritzy Montauk Resort was a pandemic winner — until Lloyd Goldman’s $217M default