Inside a Nonprofit’s Billion-Dollar Cleanup of Rent-Stabilized Debt

Community Preservation Corp has been working with distressed buildings for 50 years.

But when the organization won a joint stake in nearly $6 billion of debt from a failed bank tied to rent-stabilized buildings, it had to do things a little differently.

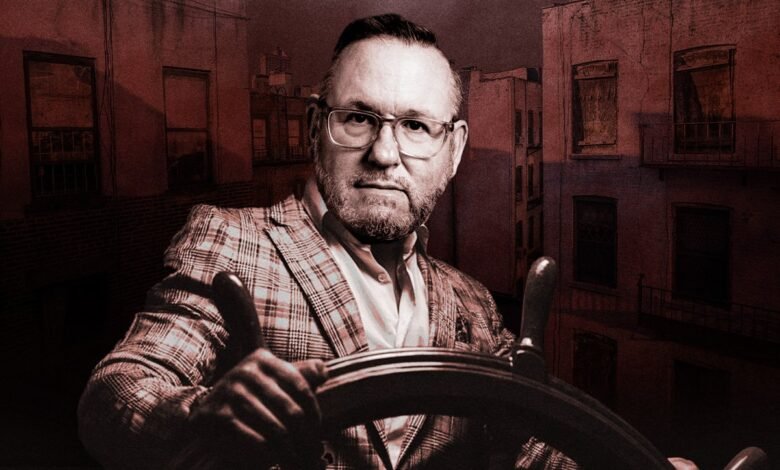

“At a high level, what we’re doing is a process we’re very familiar with,” said Robert Riggs, senior vice president at CPC. “Some of the tools we’re using are new to us.”

The number one tool at the nonprofit’s disposal: loan modifications, which CPC has just started rolling out. The lender is betting it can turn around loans tied to rent-stabilized buildings, for whom inflation, an elevated interest rate environment and recent statewide laws have created a financial nightmare.

When the CPC partnered with Related Fund Management and the nonprofit Neighborhood Restore to win the $5.8 billion stake from the FDIC, it expected to find distress.

Signature Bank, the original lender, was seized by regulators in 2023. It was a major creditor for the rent-stabilized market, where expenses have risen and income growth is limited. Of the nine pools of its loans up for sale, CPC bought the most troubled.

Where distress was expected, it was found. About one-quarter of the loans in the portfolio are in payment default. Seventy percent have other red flags for financial distress, up from 54 percent in February 2024.

Financial trouble is often followed by declining property conditions, which CPC also tracks. About 39 percent of the loans are associated with some sort of physical distress, such as a high number of hazardous violations documented by the city. That’s up about 8 percentage points since last February.

The lender’s strategy is to modify the loans to restore cash flow and improve building conditions. That means maturity extensions, rate relief and, if necessary, principal forgiveness.

This is not an easy road for the borrowers, according to Riggs. CPC requires that they address physical violations in their buildings and come current on past due interest. A good number of the loans will require principal paydowns.

“If they don’t perform, we’re going to claw back all the favorable terms, including the principal forgiveness,” Riggs said. “The goal is not only to restore cash flow, but to create a concrete set of obligations that the borrowers have that they are very incentivized to meet.”

The modification game

Part of the reliance on loan modifications is because CPC is limited in its flexibility. A conventional lender would likely sell loans at a discount, making the buildings someone else’s problem. But the nonprofit’s operating agreement with the FDIC prohibits that kind of buckpassing. Its last resort is to foreclose on the property, becoming the owner, and holding it for a period. (In rare cases, CPC can sell to preservation owners that have been given the blessing of regulatory agencies.)

CPC’s joint venture has approved accelerating one-quarter of the loans in the portfolio and has already filed 41 foreclosures affecting about 2,200 units.

“The least disruptive path for the building and the tenants is to keep the ownership in place and restructure the loan,” Riggs said. “Our experience is that most owners want to maintain their buildings and want to perform under their loans”

A tenant-conscious approach, including convening renters to hear about issues in their buildings, has been appreciated by groups like the Association for Neighborhood and Housing Development, said Barika Williams, that group’s executive director. The lender’s stakeholder roundtable includes government representatives, nonprofit organizations like ANHD and landlord groups.

“Everything I’ve seen thus far has given me the confidence that they’re approaching it in a way that’s looking to be sensitive to the impact on the community,” said Jim Buckley, executive director of the University Neighborhood Housing Program, which has been part of discussions.

The lender modified its first loan last month, about a year and a half after it took over the debt. As of mid-June, CPC had term sheets out for 25 percent of loans. Riggs said the wait was due to the complexity of the process, including FDIC requirements that the organization get business plans approved.

The modifications will provide some immediate relief. But reducing violations and meeting capital needs in the buildings is still months away.

“We’re going to start fixing, loan by loan, the economics. And the building conditions will follow,” Riggs said. “It’s a slow ship to turn around.”

Suzannah Cavanaugh contributed reporting.

Read more

Shunned parties, discounts aplenty: FDIC releases Signature Bank loan bids

Related, Community Preservation Corp win stake in Signature rent-stabilized loans