Prime Group Nabs $156M Refi from Affinius and 3650 Capital

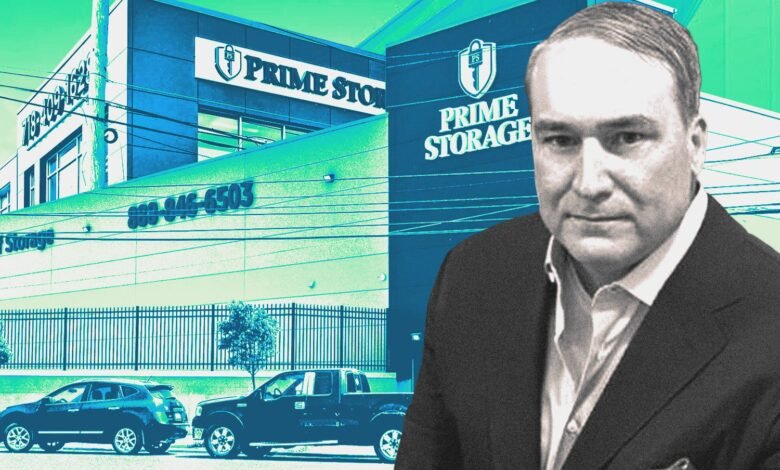

Prime Holdings Group scored a $156 million refinancing on a trio of outer-borough self-storage properties from Affinius Capital and 3650 Capital.

The floating-rate loan secured by the self-storage giant replaces the previous $147 million loan on the properties made in 2022 from SREC REIT holdings, according to property records. Prime bought the portfolio for a combined $187 million in 2017.

Drew Anderman of CBRE Capital Markets’ Debt & Structured Finance arranged the financing, along with Eddie Haber, AJ Bruno and Jared Fried.

Headquartered in Saratoga Springs, Prime Group is the country’s largest investor in self-storage, channeling $264 million into the sector last year, according to a StorageCafe report. In June 2024, Prime announced that it had acquired 30 storage properties comprising about 1.7 million rentable square feet across 10 states. In December, it purchased a heavily discounted West Chelsea office building for $50 million, for which it plans a combination of self-storage and traditional office space.

A representative for Prime Group could not be immediately reached for comment.

The loan covers three Prime Storage facilities with just over 7,200 units between them: a 104,200-square-foot property at 1084 Rockaway Avenue in Brooklyn, a 96,400-square-foot property at 1260 Zerega Avenue in the Bronx, and a 158,300-square-foot property at 31-07 20th Avenue in Queens.

Self-storage has fielded mounting investor interest in recent years, according to Anderman, who arranged the deal. “More lenders are lending on it versus seven or eight years ago when self-storage wasn’t as well known as multifamily, hospitality, retail and so forth,” he said.

It’s an asset class that typically does well in cities with large renter populations (69 percent of New Yorkers rent) and a tight vacancy rate (0.7 percent in New York City). Plus, self-storage tends to have low turnover.

“There’s a long occupancy that usually exists for people storing things,” said Anderman. “It’s out of sight, out of mind.”