Who’s Afraid of Market-Rate Condos in Brooklyn?

If the game show “Family Feud” asked contestants to name “things that scare people,” they might say horror movies, spiders and the dark.

But in progressive neighborhoods of New York City, “market-rate condos” would make the list.

Many debates over whether to rezone for mixed-income multifamily boil down to, “Well, if we do nothing, they’ll build market-rate condos” — “luxury units” that “nobody can afford” and would “price out” longtime residents. A true boogeyman.

Usually a deal is reached for a mix of market-rate and affordable rentals, and people move on with their lives.

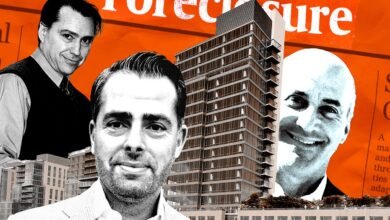

But sometimes, negotiations fail and a developer does, in fact, build market-rate condos. Such was the case last decade when then-Council member Brad Lander and Fortis Property Group couldn’t come to terms on a Cobble Hill project.

Now it is happening again at a Crown Heights site where a Bruce Eichner rental project was rejected for fear of gentrification and shadows. The offering plan for Yitzchok Schwartz’s condominium at 960 Franklin Avenue, as TRD’s Sheridan Wall reported, prices units at more than $1,200 per square foot. The cheapest is $600,000.

The development’s 300 apartments will all be one or two bedrooms. That’s another thing politicians don’t like: projects that don’t have units for “families” (even though three-bedrooms are often rented to roommates).

But guess what? A boogeyman is defined as “a monstrous imaginary figure” invoked to scare children. Adults in Crown Heights should not be afraid of Schwartz’s modest-sized, market-rate condos.

The building is filling a former factory site and won’t displace anyone, directly or indirectly. Instead of attracting several single people splitting the rent, condos will attract young couples, small families and empty-nesters who will put down roots.

The city, state and Metropolitan Transportation Authority will collect transfer taxes each time a unit sells — about $2.4 million for the first round of sales, plus about $9 million in commissions to real estate agents.

The 300 households will pay more than $6 million annually in city and state income taxes. Some will become patrons of the Brooklyn Botanic Garden, Brooklyn Museum and Prospect Park, which are all within walking distance. Doormen will enhance street safety.

If market-rate condos are the worst thing that happens in Crown Heights, all neighborhoods should be so lucky.

What we’re thinking about: In 2012, a Colorado-based REIT called UDR and MetLife paid $635 million for 801 Amsterdam Avenue and 775, 795, 805 and 808 Columbus Avenue, but now are looking to sell the portfolio for $450 million to $500 million. The five buildings are free-market rentals. Other than interest rates being 400 basis points higher today, what accounts for their decline in value? Send your thoughts to eengquist@therealdeal.com.

A thing we’ve learned: Rejected names proposed for the new hybrid-electric Governors Island ferry include the Gov Boat, Boaty McBoatface, Watts Up Doc and Ferry Impressive, the New York Times reported.

Elsewhere…

— The state lost out on $485 million in federal money when it did not transfer Medicare-eligible seniors off Medicaid between 2016 and 2021, according to the state comptroller, City & State reported. While the missed funding pales in comparison to what the state spends on Medicaid (a projected $109.6 billion this fiscal year), the news comes as New York faces broader federal funding cuts.

— Animal-rights activists rallied outside Thursday’s City Council meeting following the death of a Central Park carriage horse named Lady, amNY reported. The group was supporting a new bill called Ryder’s Law, which would eliminate New York’s carriage horse industry.

— The Council will likely override the mayor’s veto of two bills that would raise the minimum pay of grocery delivery workers, according to remarks made ahead of the Council’s Thursday meeting. The override vote will likely be held next month.

— Quinn Waller

Closing time

Residential: The top residential deal recorded Thursday was $16.8 million for a 4,510-square-foot, sponsor-sale condominium unit at 50 West 66th Street in Lincoln Square. Beth Benalloul and Hilary Landis of the Corcoran Group had the listing.

Commercial: The top commercial deal recorded was $41 million for roughly 72,000 square feet of retail space at 1600 Flatbush Avenue in Brooklyn. Triangle Equities sold the commercial condo to developer Parviz Farahzad.

New to the Market: The highest price for a residential property hitting the market was $21 million for a 3,576-square-foot condominium unit at 432 Park Avenue in Midtown. Asher Alcobi of Peter Asche has the listing.

Breaking Ground: The largest new building project filed was for a proposed 20,470-square-foot, 18-unit residential property at 404 West 50th Street in Hell’s Kitchen. Bojidar Kadiev filed the permit on behalf of Benjamin Braka of Aetna Real Estate Management.

— Matthew Elo