Snap Posts Strong Numbers in Q4, But Questions Remain About Growth

Snapchat has published its latest performance update, which shows an increase in users in Q4 2024, and a higher-than-expected revenue result. Though concerns still linger for the app, which remains at a difficult point in its development.

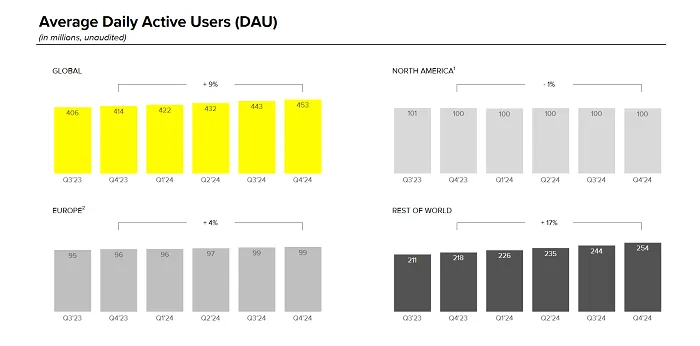

First off, on usage. Snapchat added 10 million more users in Q4, taking it to 453 million daily actives.

Snapchat is nothing if not consistent. If you look at the growth figures here, quarter on quarter, Snapchat has added almost exactly the same amount, around 9 million extra users on average, over the past five quarters.

So Snap is growing, though it’s not gaining momentum. Which is not so bad, as adding millions more actives is a positive, though its regional growth is still something to note within that broader expansion.

Because while Snap is adding users in the “Rest of world” category, it lost users in America throughout the year, and was basically flat in Europe.

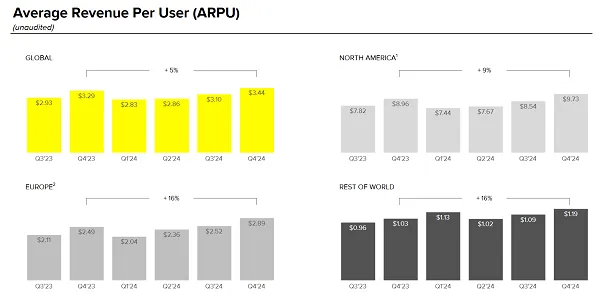

Which is a potential problem when you also factor in these number:

Snapchat still makes way more money from its North American users, and those in more developed markets. So while growth in Asia, most notably India, is propping up Snap’s numbers, it’s still not gaining in the regions that would be of most benefit to its bottom line.

That bodes well for future potential, but less so for its immediate prospects.

Yet even so, Snap is making money, with the app posting a 14% year-over-year increase in the quarter, bringing in $1.56 billion in total.

For the year, Snap generated $5.36 billion, a 16% year-over-year increase. So Snap’s business performance is improving, despite its lack of U.S. and EU user growth, which is a testament to the Snap team improving its ad offerings, and maximizing its opportunities in key markets. Indeed, the company doubled its number of active advertisers in the Q4 period.

As per Snap:

“Direct Response ad revenue growth was up 14% year-over-year in Q4 and was the largest driver of our ad revenue growth in 2024. Strong demand for Pixel Purchase and App Purchase Optimizations led to revenue from app-based purchase optimizations growing more than 70% YoY in Q4.”

So Snap is doing better with the opportunities that it has, and is building on its existing audience reach. And that’s driving results that are better than many expected, though I remain cautious about its future expansion prospects, as there are only so many ads that it can display before reaching saturation point.

In terms of other opportunities, Snap says that Snapchat+ subscribers grew from 7 million to 14 million in 2024, with the program now bringing in an additional $500 million in annual revenue. That means that Snap added 2 million more Snapchat+ subscribers over the Christmas period, with its promotions around gifting Snapchat+ clearly having an impact.

Though that result also serves as another reminder of why subscription social is difficult, because despite all of Snap’s success, in getting 14 million people to pay for its add-on features, it’s still just a fraction of the company’s overall revenue.

Which is why Elon Musk’s ambitious plan to generate half of X’s revenue from subscriptions was always going to be a big ask. For context, X Premium currently has around 1.3 million total subscribers.

Snapchat+ has been far more successful, providing a package of add-ons that Snap users actually want. But it’ll always be a supplemental revenue stream.

In terms of content, Snap says that more than a billion Snaps were shared publicly each month in Q4, which is also a big shift, given that Snap has traditionally been a more private, enclosed platform. Its efforts to get more creators sharing their updates in the app, via monetization incentives, is seemingly generating results, though I would also note that the growth of Spotlight, its TikTok-like video feed, would have been another key factor in this respect.

Still, more publicly available content means more options to keep users entertained, and engaged in the app, so this is a relevant note for Snap’s opportunities.

On its future bets, Snap says that it’s recently developed a “groundbreaking” new generative AI model, which is capable of generating high-resolution images on mobile devices “in just seconds.”

The model, Snap says, runs entirely on device, which significantly reduces computational cost compared to larger, server-reliant models.

“We’re excited to bring this technology into production in the coming months to help power some of Snapchat’s AI features, such as AI Snaps, AI Bitmoji Backgrounds, and more. By implementing this in-house built technology, we’ll be able to offer our community fast, high-quality AI tools at a lower operating cost.”

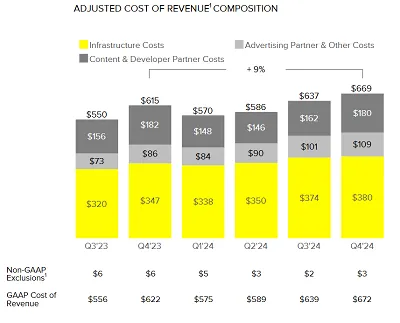

Which is also a worthy note, considering Snap’s infrastructure costs are still rising.

Part of that, of course, is going towards its coming AR glasses, which it’s still testing with developers, with a view to a future release.

Snap shared a first look at the device last year, and it says that these are now in the hands of developers in the U.S., Austria, France, Germany, Italy, Netherlands, and Spain.

Snap also recently announced a new program that’ll enable teachers and students to access its AR glasses at lower cost, which it’s hoping will be another avenue to broader adoption of its AR device.

But I don’t see it. I don’t see how Snap has any chance of being able to produce these glasses at lower cost without them being of significantly lower quality than Meta’s coming AR device, while Meta’s glasses, through its partnership with EssilorLuxottica, are more likely to be more fashionable and appealing to a broader audiences.

And Meta’s Ray Bans, now with access to Meta AI, are already popular, so I don’t see how Snap plans to viably compete with Meta for market share, given that Meta’s eventual AR glasses will be better looking, likely cheaper, and more technologically developed than Snap’s AR spectacles.

Maybe Trump’s tariffs on China will have an impact, though with Zuckerberg looking to cosy up to team Trump wherever he can, that also seems more likely to benefit Meta over Snap.

There could be something that I’m missing, but if I were a Snap investor, I’d be pushing for more details on the roadmap for this project. And if it’s just “Take on Meta and hope for the best,” maybe it’s time to pull the plug and concentrate on other areas.

Either way, Snap’s nous for AR effects remains a significant selling point, with Lens usage (in terms of posted Snap’s that used Lenses) increasing 49% year-over-year.

It’s a positive report card for Snap overall, and a solid endorsement of its business focus, which has seen it put more effort into signing up more ad clients, and making more money, as opposed to relying on the benefits of ongoing growth. Because while Snap is growing, it’s not shifting in its key revenue markets, which has put more focus on capitalization, as opposed to expansion in these regions.

And that’s also a negative, because if Snap’s growth is restricted, and/or it’s reached its peak in these areas, then it can only make so much revenue from these users. Which puts more pressure on the company to improve its prospects elsewhere, through new partnerships in Asia and EU. Asia could present more potential in this respect, but EU is always tough, and I’m not sure I’d be banking on that being a pathway to significant revenue growth.

Which means that the concerns for Snap remain, in regards to where it goes next, and what it does to significantly drive its market trajectory. Sure, improvement in the U.S. is great, but if you’re not adding users, that’ll also be limited, and the numbers here might just be reflective of the holiday promotions blitz.

Snap’s Q1 2025 results could tell a different story, while I remain skeptical of its future growth plans, both in AI and AR, due to the scale of competition stacked against it.

Source link